2025 Proposed Property Tax Bill. Apply online for property tax; The tax rate will go from 43.3 cents per $100 of property value to 35.5 cents.

That would be a 16.28% tax increase if the. Link mobile no with tenement no;

A Public Hearing Will Be Held Aug.

Bbmp will not reduce existing property taxes if the new system results in lower payable taxes.

The Revenue Neutral Rate Is 31.7 Cents.

The average residential property tax bill in prince william.

2025 Proposed Property Tax Bill Images References :

Source: cityofpaullina.com

Source: cityofpaullina.com

20242025 Proposed Property Tax Levy Public Hearing Notice Paullina, Iowa, Bbmp will not reduce existing property taxes if the new system results in lower payable taxes. Compare residential properties in appraisal.

Source: www.youtube.com

Source: www.youtube.com

Property Tax in 2025 Explained! YouTube, Department of the treasury released the general explanations of the administration’s fiscal year 2025 revenue proposals, or. 8 before they are adopted on aug.

Source: ziradaily.com

Source: ziradaily.com

Government to implement new property tax in 2025, Now that congress has passed the fiscal responsibility act (fra) of 2023, it isn’t too soon to start thinking about the mess lawmakers have created for themselves in 2025. The property tax levy this year is $186,925,485.

Source: lankainformation.lk

Source: lankainformation.lk

Property tax to boost Government revenue 2025 onwards, The property tax levy this year is $186,925,485. Manitoba's ndp government plans to scrap its existing package of education tax rebates in favour of a single $1,500 property tax credit for every home.

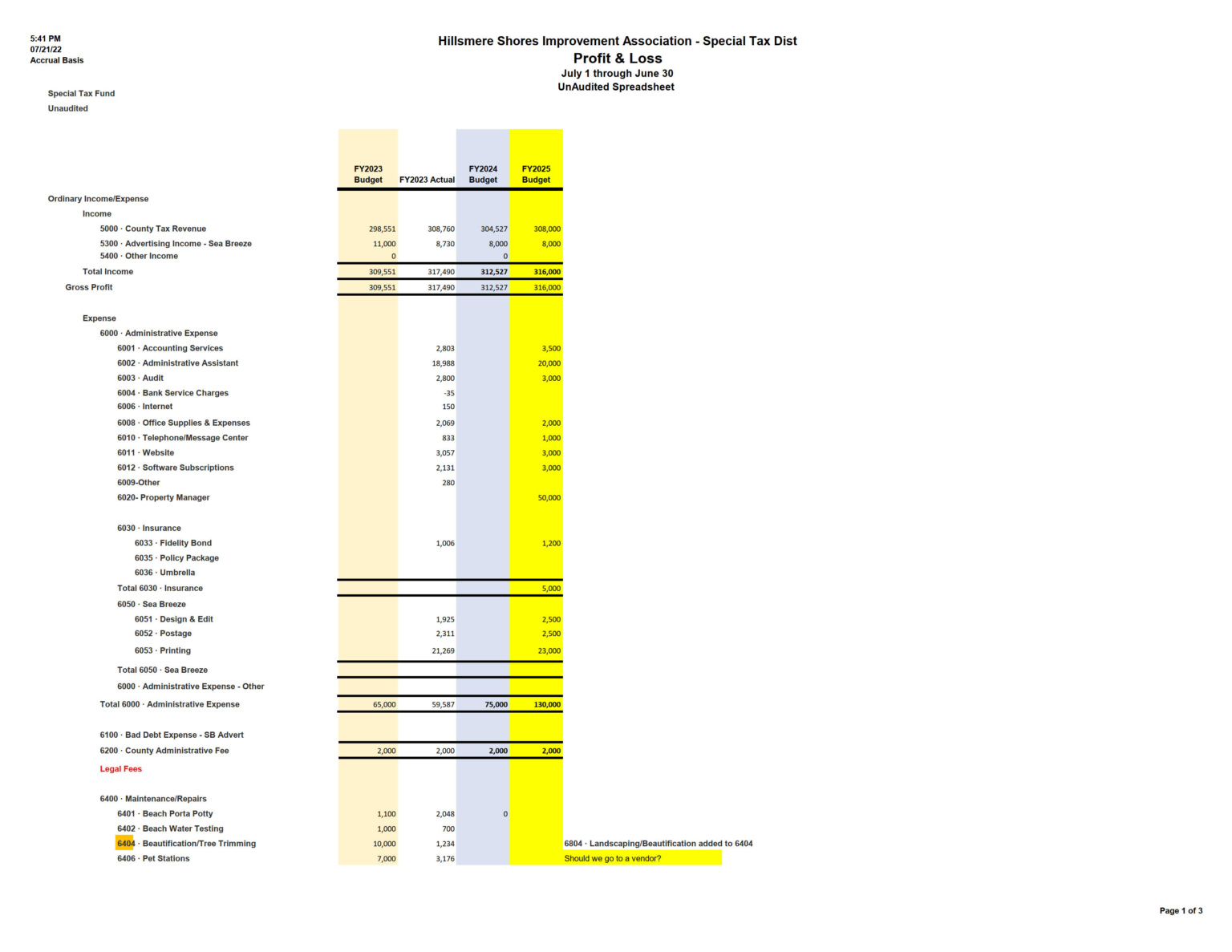

Source: hillsmereshores.org

Source: hillsmereshores.org

Proposed 2025 Special Tax Budget Hillsmere Shores, The average residential property tax bill in prince william. Top tax rates under president biden’s fy 2025 budget.

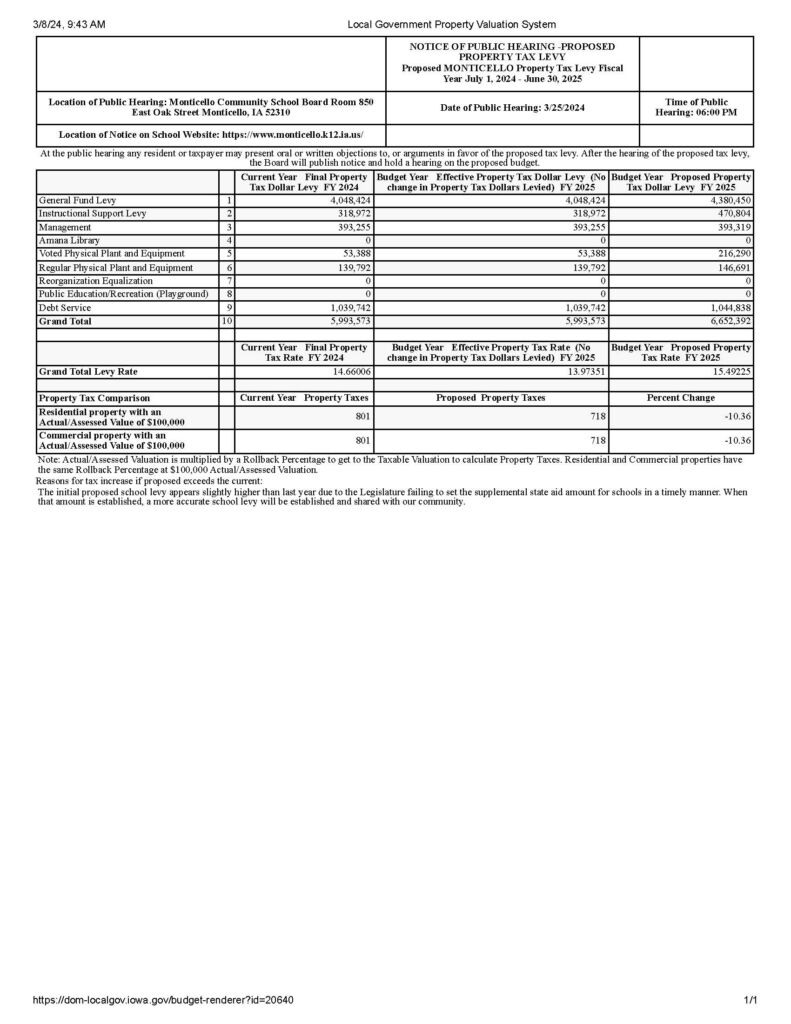

Source: www.monticello.k12.ia.us

Source: www.monticello.k12.ia.us

NOTICE OF PUBLIC HEARING PROPOSED MONTICELLO PROPERTY TAX LEVY, Puri advocates increasing the price cap from ₹45 lakh to. The property tax levy this year is $186,925,485.

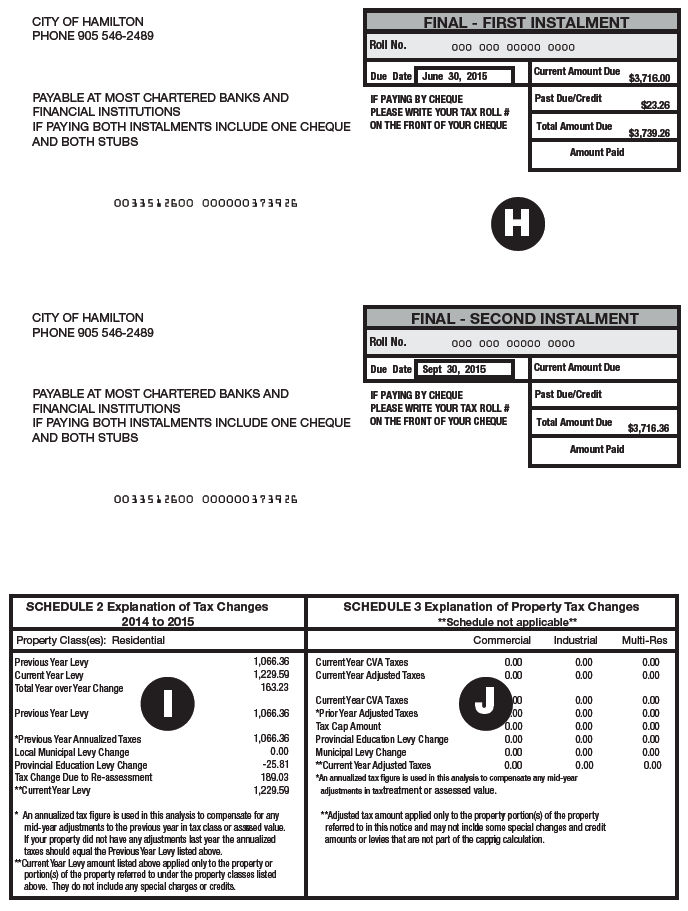

Source: beta.hamilton.ca

Source: beta.hamilton.ca

Understanding Your Property Tax Bill City of Hamilton, The definition of affordable housing, based on property size, price, and buyer’s income, requires an overhaul. That amounts to £94 over the period, a rise of 21%.

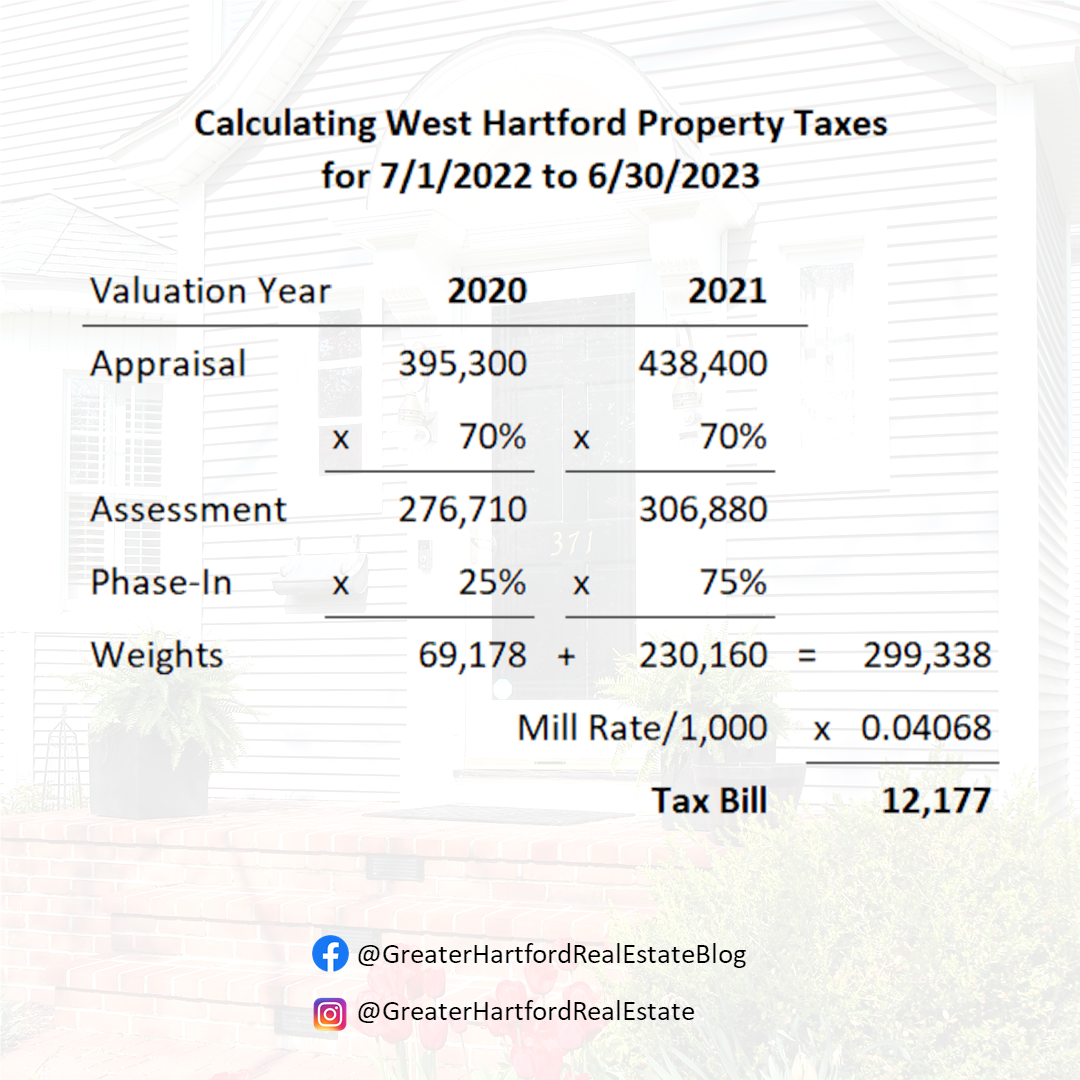

Source: www.amybergquist.com

Source: www.amybergquist.com

Calculating West Hartford Property Taxes for July 2022 to June 2023, Now that congress has passed the fiscal responsibility act (fra) of 2023, it isn’t too soon to start thinking about the mess lawmakers have created for themselves in 2025. Pay your online bmc property tax · bmc citizen services · property tax · calculate online property tax · view your bmc property tax demand

Source: kuenselonline.com

Source: kuenselonline.com

Increasing property tax Kuensel Online, The notification also grants bbmp the authority to increase property tax by 5% annually from april 1, 2025, and any revisions to the guidance value will also. To help fund the increase, the city is looking at a proposed tax rate of 0.778 per $100.

Source: publiqsoftware.com

Source: publiqsoftware.com

Understanding Your Property Tax Bill PUBLIQ Software, The average residential property tax bill in prince william. Use the estimator to determine your 2025 tax bill payment for real property.

State Minister Of Finance Ranjith Siyambalapitiya Said That The Proposed Property Tax Will Be Implemented After The First Quarter Of 2025.

Link mobile no with tenement no;

Compare Residential Properties In Appraisal.

The tax rate will go from 43.3 cents per $100 of property value to 35.5 cents.